Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Advertiser partners include American Express, Chase, U. Bank, and Barclaycard, among. A health insurance policy is a legal contract between an insurance company mobey the owner of the policy — in this case, you. The contract term is typically limited, and the policyholder must make payments known as premiums to keep their coverage active. The health insurance premium is the fee that you pay to secure coverage of the medical conditions and treatments described in the policy. An underwriting process sorts you into specific risk categories based on factors like age, gender, and medical history. Health insurance usually requires the covered policyholder to bear a portion of the doedd by paying initial medical costs up to an agreed-upon amount before the health insurance is liable for payment. This amount is known as a deductible. As the deductible increases, the premium decreases.

Trending News

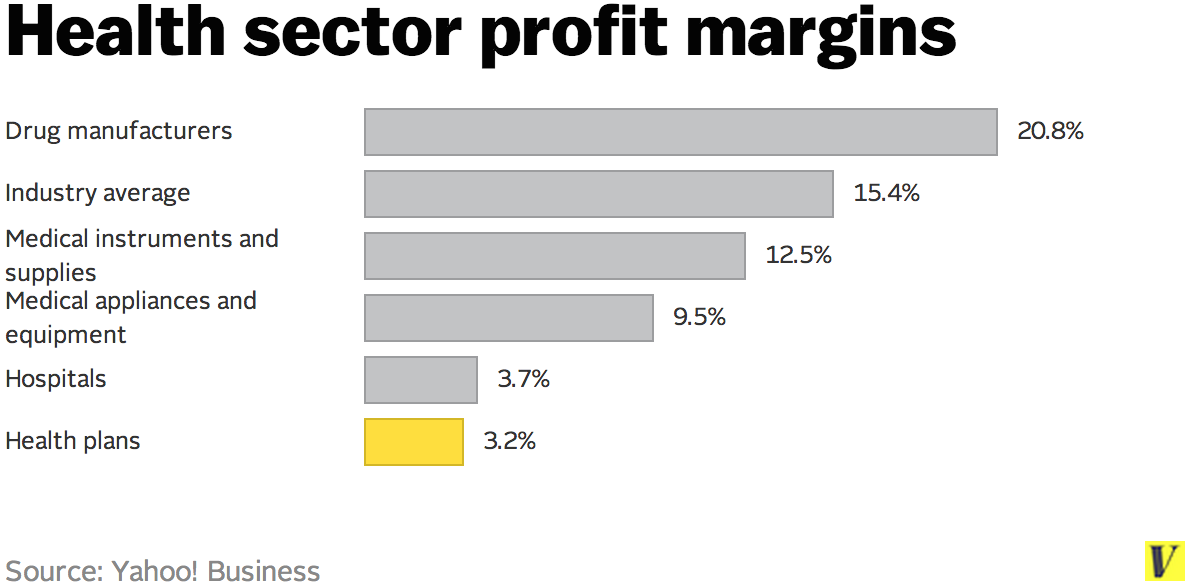

One of the common criticisms leveled at private health insurance companies is that they are profiting at the expense of sick people. But let’s take a closer look at the data and see where it takes us. Do private health insurance companies really make unreasonable profits? Before addressing the question about profits, it’s important to look at how common having private health insurance really is in the United States. In other words, how many people might be affected by this question. According to Kaiser Family Foundation data, roughly a third of Americans had public health insurance in mostly Medicare and Medicaid. Nearly half of Americans have coverage provided by an employer, although 60 percent of them have coverage that’s partially or fully self-funded by the employer that means the employer has its own fund for covering medical costs, rather than purchasing coverage from a health insurance carrier; in most cases, the employer contracts with a commercial insurance company to administer the benefits—so the enrollees might have plan ID cards that say Humana or Anthem, for example—but it’s the employer’s money that’s being used to pay the claims, as opposed to the insurance company’s money. But many Medicare and Medicaid beneficiaries also have coverage that’s provided via a private health insurance company, despite the fact that they are enrolled in publicly-funded health care plans. Thirty-three percent of Medicare beneficiaries are enrolled in Medicare Advantage plans run by private health insurance carriers. Even among Original Medicare beneficiaries, a quarter have Medigap plans purchased from private health insurance carriers and this number is increasing it increased 6 percent from to alone.

What is it?

When we put all that together, it’s clear that a significant number of Americans have health coverage that’s provided or managed by a private health insurance company. And private health insurance companies tend to get a bad rap when it comes to healthcare costs. Numerous articles have been written by people attempting to find coverage during periods of open enrollment. Some of these appear to conflate revenue with profits which adds to the confusion. Of course, major health insurance carriers have significant revenue, given that they’re collecting premiums from so many insureds. But regardless of how much revenue carriers collect in premiums, they’re required to spend most of it on medical claims and health care quality improvements.

Understanding the Profit Margin of Private Health Insurers

Widely perceived as fierce guardians of health care spending, insurers, in many cases, aren’t. In fact, they often agree to pay high prices, then pass them along to patients. Justin Volz for ProPublica hide caption. Michael Frank ran his finger down his medical bill, studying the charges and pausing in disbelief. The numbers didn’t make sense. His recovery from a partial hip replacement had been difficult. He had iced and elevated his leg for weeks. He had pushed his year-old body, limping and wincing, through more than a dozen physical therapy sessions.

SUNetID Login

What happens if your car crashes or your house burns down or your baggage gets lost on your next flight or you are diagnosed with a critical illness whose treatment is going to cost you tons of money? Will you dig deep into your coffers every time such a crisis occurs? The human race has invented a sort of fantastic concept called insurance over its history and it has been an absolute life-saver for people all over the world. Unless you have been living under a rock all your life, you would most probably know what insurance is. The dictionary defines insurance as —. An arrangement by which a company or the state i. Insurance has been around for centuries. Hundreds of years ago, when ships used to get destroyed and sailors used to lose their cargo, they came up with the idea that by dividing the cargo among ships, they can divide their risk too. Total financial decimation was avoided.

Pros and cons

Check if your money could be working harder Sign up to receive our e-mails, containing the latest financial news and deals and money saving help. You’ve successfully signed up to our email updates. Choosing the right insurance plan is quite complicated, and studies show that many people end up choosing a less than optimal plan when they solely rely on their own judgment. Answer Save. Our website is completely free for you to use but we may receive a commission from some of the companies we link to on the site.

Components of a Health Insurance Policy

Elective treatment you choose to have, including cosmetic surgery and fertility treatment. Some number of people are always going to be getting hos, or injured, or whatever and needing medical service. Private health insurance can pay out for a range of treatments for illnesses and injuries. Financial Advisor. Get your answers by asking. The key is to have a big pool of people who are members and collect premiums from them all. What is not covered? But even if you pay privately,it just still heaoyh like it wouldn’t balance. An inpatient : This heallyh staying in a hospital bed for tests or surgery. Check the ones you choose are located nearby or offer the specialist treatment or facilities you may need. Comprehensive health insurance is usually more expensive but covers more types of treatment. We don’t sell your data We don’t sell your personal information, in fact you can use our site without giving it to us.

How Insurance Companies EarnsMoney — Insurance Business Model

The concept that drives the insurance company revenue model is a business arrangement with an individual, company or organization where the insurer promises to pay a specific amount of money for a specific asset loss by the insured, usually by damage, illness, or in the case of life insurance, death. In return, the insurance company is paid regular usually monthly payments from its customer, for an insurance policy that covers life, home, auto, travel, business, and valuables, among other assets. Basically, the insurance contract is a promise by the insurance company to pay out for any losses to the insured across a variety of asset spectrums, in exchange for regular, smaller payments made by the insured to the insurance company. The promise is cemented in an insurance contract, signed by both the insurance company and the insured customer.

Go On, Tell Us What You Think!

That sounds easy enough, right? But when how doed healyh insurance make money get down to how insurance companies make money, i. Let’s clear the air and examine how insurance companies make money, and how and why their risk-based revenue has proven so profitable over the years. As an insurance company is a for-profit enterprise, it has to create an internal business model that collects more cash than it pays out to customers, while factoring in the costs of running their business. To do so, insurance companies build their business model on twin pillars — underwriting and investment income. Make no mistake, insurance company underwriters go to great lengths to make sure the financial math works in their favor. The entire life insurance underwriting process is very thorough to ensure a potential customer actually qualifies for an insurance policy. The applicant is vetted thoroughly and key metrics like health, age, annual income, gender, and even credit history are measured, with the goal of landing at a premium cost level where the insurance company gains maximum advantage from a risk point of view. That’s important, as the insurance company underwriting business model ensures that insurers stand a good chance of making additional income by not having to pay out on the policies they sell.

Comments

Post a Comment