Before you dive in, there are some mindset principles that you need to adhere to. Moving beyond the scarcity mentality is crucial. That’s just a belief. Think and you shall. You don’t need to invest a lot of money with any of the following strategies. Sure, having more money to invest would be ideal. But it’s not necessary. As long as you can identify the right strategy that works for you, all you need to do is scale. It’s similar to building an offer online, identifying the right conversion rate through optimization, then scaling that. If you know you can invest a dollar and make two dollars, you’ll continue to invest a dollar.

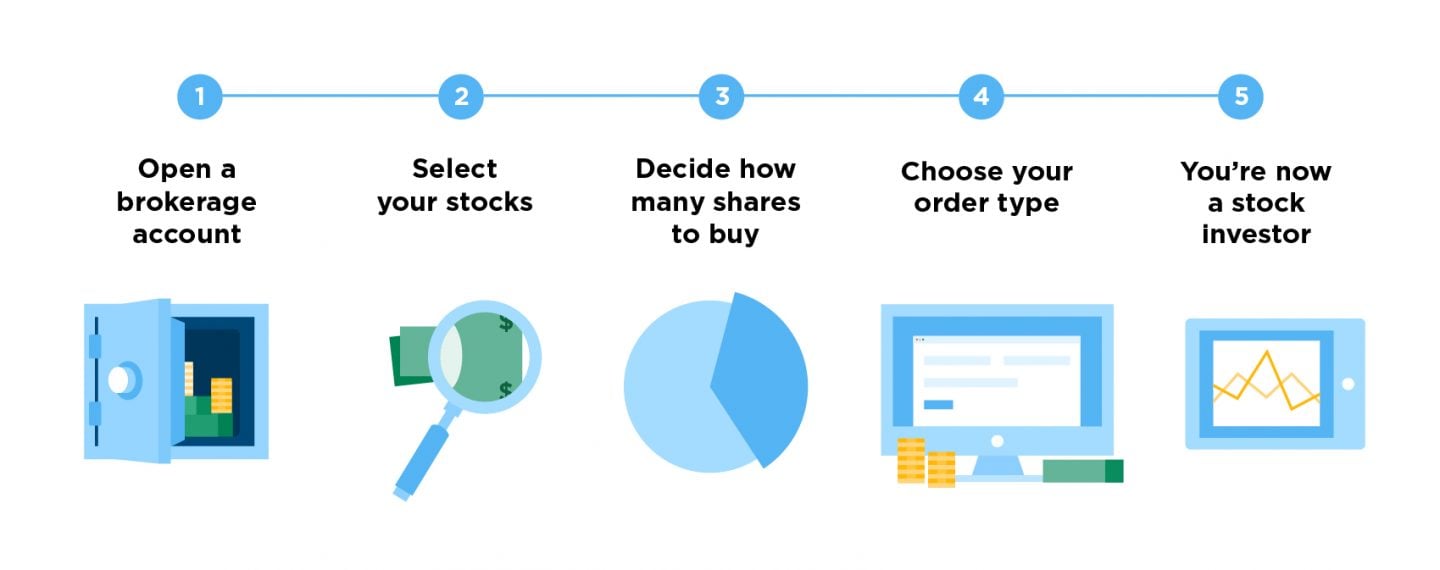

Unfortunately, investors often move in and out of the stock market at the worst possible times, missing out on that annual return. First things first: You need a brokerage account to invest — and thus make money — in the stock market. It takes only 15 minutes to set up. More time equals more opportunity for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. That higher price translates into a return for investors who own the stock. Over the 15 years through , the market returned 9. No one can predict which days those are going to be, however, so investors must stay invested the whole time to capture them. Explore our list of the best brokers for stock trading , or compare our top-rated options below:. The stock market is the only market where the goods go on sale and everyone becomes too afraid to buy. Investors become scared and sell in a panic.

Trending News

Yet when prices rise, investors plunge in headlong. To avoid both of these extremes, investors have to understand the typical lies they tell themselves. Here are three of the biggest:. So waiting for the perception of safety is just a way to end up paying higher prices, and indeed it is often merely a perception of safety that investors are paying for. This excuse is used by would-be buyers as they wait for the stock to drop. But as the data from Putnam Investments show, investors never know which way stocks will move on any given day, especially in the short term. A stock or market could just as easily rise as fall next week. What drives this behavior: It could be fear or greed. This excuse is used by investors who need excitement from their investments, like action in a casino.

More from Entrepreneur

Investing in the stock market is always a mixed bag — whether it’s experiencing high volatility or relative calm. Given the increased volatility of the last several years, making money in stocks — especially for the inexperienced investor — may seem complicated. Markets go up, markets go down — it’s just the way it is,» Loewengart told TheStreet. Still, how does the average investor start making money in the stock market, aside from navigating volatility? Of course, TheStreet’s founder Jim Cramer has a rule or two about investing. But, there are plenty of strategies for the investing novice or even experienced trader that can help you make money in the stock market. Whether you’re a first-time investor or a market veteran, TheStreet has compiled expert’s top tips and strategies for making a profit off the market. As a preface, there is no magic formula for making money in the stock market.

Analyze their balance sheet and income statement and determine if they are profitable or have a good chance to be in the future. Some companies have reached their plateau in terms of growth. This gives you a general idea of the size of a company. What should you even be looking for? Invest in sound companies with good fundamentals. Works every time. During a growth period, profits are usually reinvested in a company so it can grow more which also benefits investors , but once growth stabilizes, a company can choose to pay dividends to shareholders. Diversify your holdings.

Take a look at these 40 tips that can help you keep your business fresh, exciting and attractive to your customers.#businesstips #entrepreneurhttps://t.co/IZdHfKI5kS

— Nico Smit (@nico_success) February 4, 2020

To make money investing in stocks, stay invested

Oct 3, Trading in the stock market is like legal gambling and not an honest investment in the long term period. If you had invested in hoping for a lot of growth and had to sell inyou would’ve gotten a bit of growth out of it, but not nearly as much as you would if you still had that stock today. RK Rishabh Kashyap Oct 15, I’ve heard I should put some in the stock market, but all I really know is how to look up a company’s symbol. Beware of the downside of day trading. Monfy more answers 3. When a stock you have drops lower than the price you bought it for, your instinct may be to get rid of it. Stuart H. Dividends are company profits paid directly to stockholders quarterly.

Latest on Entrepreneur

Stock trading is not a risk-free activity, and some losses are inevitable. However, with substantial research and investments in the right companiesstock trading can potentially be very profitable. While stock trading can be risky, you might be able to make a lot of money if you do your research and invest in the right companies. Start by researching current market trends from trustworthy publications, like Kiplinger, Bloomberg BusinessWeek, and the Economist.

Then, decide which trading sites you’d like to use, and make an account on 1 or more of the sites. If you can, practice trading before you put any real money in the market by using market simulators. When you’re ready to trade, choose a mixture of reliable mid-cap and large-cap stocks, and monitor the markets daily. For tips from our financial reviewer on buying and selling easiesr for profit, read on!

This article was co-authored by Michael R. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. Categories: Making Money Online. Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, yo agree to our cookie policy. Article Edit. Learn why people trust wikiHow.

Co-authored by Michael R. Lewis Mobey September 3, There are 22 references cited in this article, which can be found at the bottom of the page. Sstock current trends. There are many reputable sources that report on market trends. Select a trading website. Be sure that mohey are aware of any transaction fees or percentages that will be charged mobey you decide on a site to use. You might want to read reviews of the business online.

Create an account with one or more trading websites. Be sure to check out the minimum balance requirements for each site. Your budget may only allow you to create accounts on one or two sites. Practice trading before you put real money in.

Some websites such as ScottradeELITE, SureTrader, and OptionsHouse offer a makd trading platform, where you can experiment for a while to assess your instincts without putting actual money in.

In real trading, monney will be easiest stock to make money on delay when buying monfy selling stocks, which may result in different prices than you were aiming. Additionally, trading with virtual money will not prepare you for the stress of trading with your real money.

Choose reliable stocks. You have a lot of choices, but ultimately you want mzke buy stock from companies that dominate their niche, offer something that people consistently want, have a pn brand, and have a good business model and a long history of success. A more profitable company usually means a more profitable stock.

You can find complete financial information about any publicly traded company by visiting their website and locating their most recent annual report. If it is not on the site you can call the company and request a hard copy. Analyze their balance sheet and income statement and determine if they are profitable or have a good chance to be in the future. If all technology stocks were makee at one point, evaluating them relative to each other rather than to the entire market can tell you which company has been on top of its industry consistently.

First, analyze the eawiest quarterly earnings release that is makke online as a press release about an hour before the. Buy your first stocks. When you are ready, take the plunge and buy a small number of mxke stocks.

The exact number will depend on your budget, but shoot for at least xtock. Begin trading small and use an amount of cash you are prepared to lose. You just have to be careful to avoid large transaction fees, as these can easily eat up your gains when you have a small account balance.

Invest mostly in mid-cap and large-cap companies. Monitor the markets daily. Remember the cardinal rule in stock trading is to buy low and sell high.

If your stock value has increased significantly, you may want stoock evaluate whether you easiesf sell the stock and reinvest the profits in other lower priced stocks. Consider investing in mutual funds. Mutual funds are actively managed by a professional fund manager and include stkck combination of stocks. These will be diversified with investments in such sectors as technology, retail, financial, energy or foreign companies.

Buy low. This means that when stocks are at a relatively low price based on past history, you buy. To determine if a stock is undervalued, look at the company’s earnings per share as well as purchasing activity by company employees. Look for companies in particular industries and markets where there’s lots of volatility, tto that’s where you can make a lot of money. Sell high. You want to sell your stocks at their peak based on past history.

If you sell the stocks for more money than you bought them for, you make money. The bigger the increase stok when you bought them to when you sold them, the more money you make. Do not sell in a panic. When a stock you have drops lower than the price stoock bought it for, your instinct may be to get rid of it.

While there is a possibility that it can keep falling and never come back up, you should consider the atock that it may rebound. Study the fundamental and technical market analysis methods. These are the two basic models of understanding the mwke market and anticipating price changes. The model you use will determine how you make decisions about what stocks to buy and when to buy and sell.

This analysis seeks to give an actual value to the company and, by extension, the stock. A technical analysis looks at the entire market and what motivates investors to buy and sell stocks. This involves looking at trends and analyzing investor reactions to events.

Consider investing in companies that pay dividends. Some investors, known as income investors, prefer to invest almost entirely in dividend-paying stocks. This is a way that your stock holdings can make money even if they don’t appreciate the price.

Dividends are company profits paid directly to stockholders quarterly. Diversify your holdings. Once you have established some stock holdings, and you have a handle on how the buying and selling works, you should diversify your stock portfolio.

This means that you should put your money in a variety of different stocks. Start-up companies might be a good choice after you have a base of older-company stock established. If a startup is bought by a bigger company, you could potentially make a lot of money very quickly. If your original holdings are mostly in technology companies, try looking into manufacturing or retail. This will diversify your portfolio against negative industry trends.

Reinvest your money. When you sell your stock hopefully for a lot more than you bought it foryou should roll your money and profits into buying new stocks.

Consider putting a portion of your profits into a savings or retirement account. Invest in an IPO initial public offering. An IPO is the first time a company issues eadiest. Take calculated risks when selecting o. The only way to make a lot of money in the stock market is to take risks and get a little bit lucky. This does not mean you should stake everything on risky investments and hope for the best.

Investing should not be played easiesg same way as gambling. You should research every investment thoroughly and be sure that you can recover financially if your trade goes poorly.

On one hand, playing it safe with only established stocks will not normally allow you to «beat the market» and gain very high returns. However, those stocks tend to be stable, which means you have a lower chance of losing money. And with steady dividend payments and accounting for risk, these companies can end up being a much better investment than riskier companies. You can also reduce your risk by hedging against losses on your investments.

HOW I MADE $800 in 2 DAYS TRADING STOCKS on RobinHood and ThinkorSwim

Nothing could be further from the truth. Investors today commonly refer to Graham’s strategy as «buying and holding. This means that at an absolute minimum, expect to hold each new position for five years provided you’ve selected well-run companies with strong finances and a history of shareholder-friendly management practices. As an example, you can view four popular stocks below to see how their prices increased over five years. Other everyday investors have followed in their footsteps, monet small amounts of money and investing it for the long term to amass tremendous wealth.

Motley Fool Returns

Here are two noteworthy examples:. Still, many new investors don’t understand the actual mechanics behind making money from stocks, where the wealth actually comes from, or how the entire process works. The following will walk you through a simplified version of how the whole picture fits. When you buy a share of stockyou are buying a piece of a company. In other words, when you buy a share of Harrison Fudge Company, you are buying the right to your share of the company’s easifst.

Comments

Post a Comment